10/03/2023

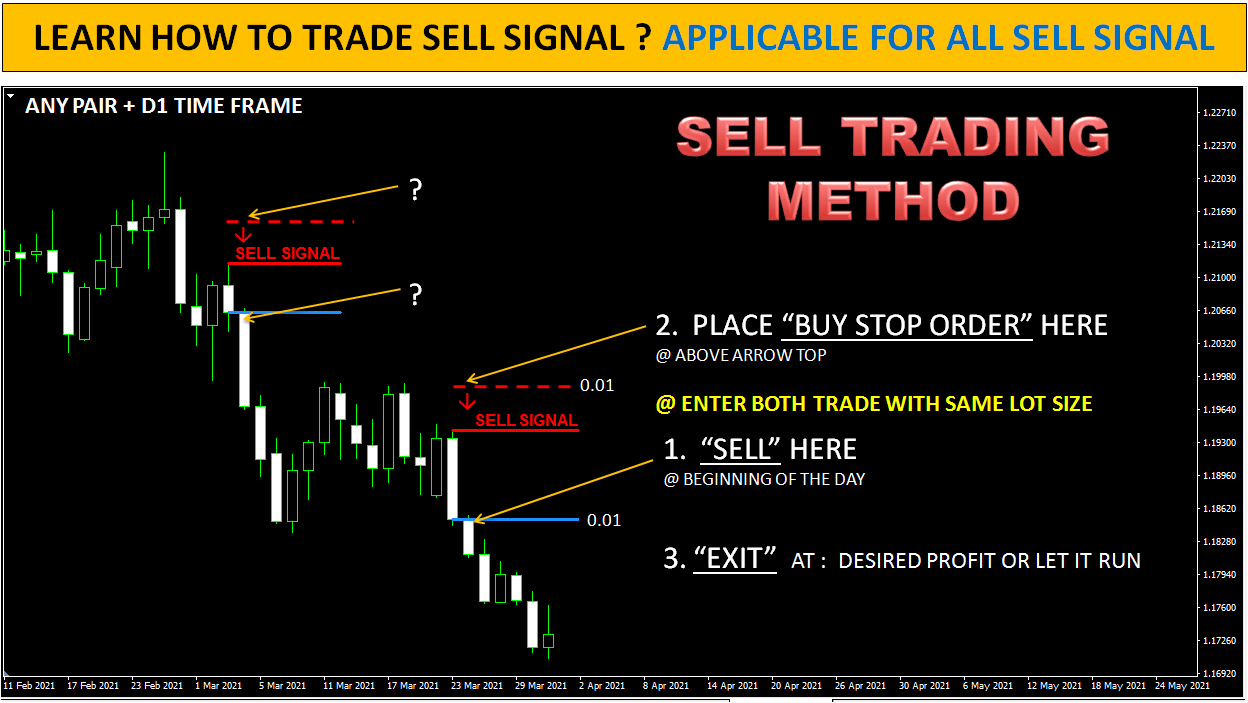

SELL SIGNAL : TRADE BELOW RESISTANCE LINE

BUY SIGNAL : TRADE ABOVE SUPPORT LINE

Click on Image to ZOOM

How to confirm and trade Buy Signals generated by Tsp Finder Pro.

In above pic we have taken Buy Signal examples...

You can also connect with me directly to + 91 93281 32758,

If any further assistance needed.

Check more signal on my Facebook Wall : Click Here

01/03/2023

TSP FINDER PRO'S - SELL PROFITABLE TRADES VS SELL HEDGED TRADE

So, when trade is hedged we need for cover that trade's loss by applying any 1 of 3 strategy, specially developed for buy hedged positions.

I will teach all 3 strategy in my "SIGNAL 2 SIGNAL" COURSE. By using any of these strategy you can easily counter any hedged position without losing from your account.

To request trial/demo, and want to see how TSP FINDER PRO generates profitable trading signals on different markets you trade. Please send request by clicking below image.

TSP FINDER PRO'S - BUY PROFITABLE TRADES VS BUY HEDGED TRADE

Tsp Finder Pro - Indicator generates profitable trading signal based on real time price action data. You can see above image, on AUDUSD chart - indicator have generated total 8 profitable trades signals back to back, without touching stop loss order area, and last 1 trade hits SL order, and it hedged.

So, when trade is hedged we need for cover that trade's loss by applying any 1 of 3 strategy, specially developed for buy hedged positions.

I will teach all 3 strategy in my "SIGNAL 2 SIGNAL" COURSE. By using any of these strategy you can easily counter any hedged position without losing from your account.

To request trial/demo, and want to see how TSP FINDER PRO generates profitable trading signals on different markets you trade. Please send request by clicking below image.

31/01/2023

LESSON : WHERE TO TAKE ENTRY AND PUT STOP LOSS ORDER FOR BUY & SELL SIGNALS

21/01/2023

Tsp Finder Pro Installation & Mt4 Chart Preparation Guide

1. Let's prepare your Meta Trader 4 platform chart first.

- Open MT4 and Download Maximum data of D1 time frame for all pairs.

2. Installation Tsp_Finder_Pro Indicator on your MT4 Trading Platform.

- Copy - paste : < Tsp_Finder_Pro Indicator > File to // MT4 INDICATOR FOLDER

- Close MT4 & Open again...

3. Prepare your chart... For Signal.

- Open EURUSD chart, load < Tsp_Finder_Pro Indicator > File on chart. You will see the signal on your chart.

How to Back-Test Tsp Finder Pro ? Right Way...

RIGHT WAY TO BACK TEST TSP FINDER PRO INDICATOR IS TO

Back-test "Tsp Finder Pro signal" Month wise.

11/12/2022

RISK SMALL AND LET YOU WIN BIG

WHAT IS POSITIVE EXPECTANCY?

~ Van Tharp

Note that the work below on expectancy and “R-multiples” is based on the original work of Van Tharp and is repeated here with his permission.

Expectancy is how much on average you are likely to make or lose when you place a trade in terms of your risk/reward ratio. An expectancy above zero means you have positive outcome.

You calculate your expectancy of your entire trading strategy by averaging the risk/reward over a series of trades, but before we get to the equation, it helps to understand what Tharp calls “R-multiples”.

THE EXPECTANCY OF YOUR TRADING STRATEGY

Now that you know what an R-multiple is, we can get back to calculating your expectancy. I know you may not have a system just yet, but don’t worry; just keep this formula in mind as something to come back to down the track.

To calculate your expectancy, first, you add up the total R-value of your Forex trades, and then you divide this total by the number of trades you have made.

Here is the formula:

For example:

If you had placed 30 trades and earned 45R in the process, your equation would look like this:

45R /30 = 1.5

In this case, your system has an expectancy of 1.5R (which is very good).